Welcome to our round up of the latest business and Covid-19 news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

Covid-19 update

Last week more than 75% of people had been double vaccinated. Wales has already met its third milestone, after offering vaccination to all eligible adults 6 weeks early and achieving 75% take up in the under 50s a month early.

New programme to help more Welsh firms export globally

The New Exporters Programme, which is one of the new support initiatives being introduced as part of the Welsh Government’s export action plan, will support companies who have either never exported before or have exported intermittently, to sell their goods and services around the world.

Ten companies from a range of sectors across Wales are being recruited to the programme, which will last around 10 months. They will receive intensive support to develop their capacity and capability for exporting, helping them to become regular exporters.

The support will be focused on exporting to Ireland initially, which will act as a starter market for the companies taking part. It will include a visit to the market, where companies will meet potential business contacts, with support from the Welsh Government’s Dublin Office. The programme will run on an annual basis.

The programme is a core part of the Welsh Government’s economic action plan, which set Ministers’ commitments to prioritising exports and trade, supporting Welsh exporters to find new markets globally.

See: New programme to help more Welsh firms export globally | GOV.WALES

Coronavirus and its impact on UK hospitality: January 2020 to June 2021

The Office for National Statistics (ONS) have released a survey on the hospitality sector during coronavirus) with a focus on the most recent easing of restrictions in spring 2021. This Includes details of how the sector has performed and the future of employment in hospitality.

The key findings are not unexpected and are summarised below:

Hospitality has been hit hard by the coronavirus (COVID-19) pandemic and the impact has been uneven; bars and clubs have fared the worst, but campsites had a relatively better year than the rest of the sector.

Consumer spending on hospitality started to increase in May 2021 but remains at less than 70% of pre-pandemic levels; a similar picture is seen in turnover – in May this remained one-quarter lower than 2019 levels.

Spending by businesses in the hospitality sector has seen smaller increases compared with consumer spending in May 2021; payments to suppliers from food and drink businesses have remained around half of pre-pandemic levels.

Confidence of business survival in the hospitality sector started to increase in May 2021 but remains below the all-sector level.

Job vacancies in the hospitality sector have seen large increases and are higher than pre-pandemic levels; however, in June 2021, the number of employees within the sector remained 11% below February 2020 levels.

See: Coronavirus and its impact on UK hospitality – Office for National Statistics (ons.gov.uk)

New Policy Papers and Consultations

On 20 July 2021, the Treasury and HMRC issued a number of policy papers and consultations flagging up possible future tax changes. Draft legislation for inclusion in the next Finance Bill has also been issued alongside some of the measures.

Among the documents these are probably the most significant:

Abolition of basis periods for income tax

A draft clause and Schedule propose to abolish basis periods for income taxed as trading profits for the tax year 2023/24 and subsequent years and provide transitional rules for the tax year 2022/23. These measures were announced as a “simplification” measure and will facilitate the introduction of making tax digital (MTD) for income tax which commences 6 April 2023. The changes will impact on sole traders, partnerships, property landlords and trusts that carry out trading or property rental activities.

The draft legislation provides for the apportionment of profits or losses of periods of account to tax years, where the period of account does not coincide with the tax year. Apportionment is to be done by reference to the number of days in each period, however the length of each period can be measured by a different method if it is both reasonable and used consistently.

A further draft clause changes the apportionment rules for property businesses, to allow those with property businesses who draw up accounts to dates between 31 March and 4 April to treat the profits between the end of their accounts and the end of the tax year as falling in the following tax year. It also allows those with property businesses commencing after 31 March to treat their business as commencing in the following tax year. This means they will no longer have to apportion small proportions of their profits between tax years.

Big Tax Bills in 2022/23?

The transitional rules proposed for the 2022/23 tax year could result in large tax bills for some sole traders and partnerships, particularly those with an existing 30 April year end. The profits of year ended 30 April 2021 would be taxed in 2021/22 under the current rules with 2023/24 taxing profits arising between 6 April 2023 and 5 April 2024 under the new rules.

The profits taxed in 2022/23 would be those for year ended 30 April 2022 plus the period 1 May 2022 to 5 April 2023 – in total 23 months profits!

There would however be a deduction for 11 months “overlap relief” which typically arose when profits were taxed twice at the start of the business – but those will often be much lower than the 11 months being taxed in 2022/23!

The draft transitional provisions will allow the taxpayer to elect to spread the excess profits over the next 5 tax years to smooth out their excessive tax bill.

See: Income Tax: basis period reform – GOV.UK (www.gov.uk)

Personal Pension age to increase to 57 from April 2028.

Draft legislation has been published with the intention of increasing normal minimum pension age (NMPA), which is the minimum age at which most pension savers can access their pensions without incurring an unauthorised payments tax charge unless they are retiring due to ill-health, from age 55 to 57 in 2028.

There follows a consultation on the implementation of the increase and a proposed framework of protections for pension savers who already have a right to take their pension at a pre-existing pension age. This consultation was launched on 11 February 2021 and closed on 22 April 2021.

Currently registered pension schemes must not normally pay any benefits to members until they reach NMPA. From 6 April 2010 the NMPA has been age 55 (before 6 April 2010 it was age 50).

Registered pension schemes are also not permitted to have a normal pension age lower than age 55 and this applies equally to individuals in occupations that usually retire before 55 (for example, professional sports people).

See: Increasing the normal minimum pension age for Pensions Tax – GOV.UK (www.gov.uk)

Changes to right to work checks from 1 July 2021

Following the deadline for applications to the EU Settlement Scheme, the process for completing right-to-work checks on EU, EEA, and Swiss citizens has now changed.

Employers can no longer accept EU passports or ID cards as valid proof of right-to-work, with the exception of Irish citizens. Instead, you need to check a job applicant’s right to work online using a share code and their date of birth. You do not need to retrospectively check the status of any EU, EEA, or Swiss citizens you employed before 1 July 2021.

You can find out more information on these changes, including what to do if you identify an EU citizen in your workforce who has not applied to the EU Settlement Scheme by the deadline and does not hold any other form of leave in the UK, by reading the full guidance.

COVID-19 GOVERNMENT SUPPORT NEWS

Below is our weekly roundup of changes to government support information generally and for businesses, employers and the self-employed.

Coronavirus Job Retention Scheme (CJRS) update

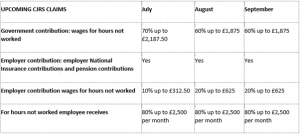

CJRS claims for July can now be submitted and must be made by Monday 16 August.

Employers can claim 70% of furloughed employees’ usual wages for the hours not worked, up to a cap of £2,187.50 per month. They will need to pay the difference, so that they continue to pay furloughed employees at least 80% of their usual wages in total for the hours they do not work, up to a cap of £2,500 a month.

Employers can still choose to top up employees’ wages above the 80% level or cap for each month if they wish, at their own expense.

From 1 August 2021, the government will pay 60% of wages up to a maximum cap of £1,875 for the hours the employee is on furlough.

The 60% support will continue until the end of September.

See: Claim for wages through the Coronavirus Job Retention Scheme – GOV.UK (www.gov.uk)

Self-Employment Income Support Scheme (SEISS) update

The claims service for the fifth SEISS grant will open from late July. In the meantime, here is the latest SEISS update from HMRC.

Personal claim dates

Shortly HMRC will be contacting every customer who may be eligible for the fifth grant, to tell them their personal claim date. Customers can claim from this date up until the claims service closes on 30 September 2021.

Claims made before the personal claim date will not be processed. This is to ensure the system is fast and easy to use for everyone on their given date, and that telephone support continues to be available for those who need it most.

Preparing turnover figures

The majority of customers claiming the fifth SEISS grant will need to provide turnover figures in order to make a claim. The turnover figures will be used to compare the ‘pandemic year’ with a ‘reference period’.

Detailed instructions on how to prepare turnover for the 12-month period starting on any date from 1 to 6 April 2020 (the ‘pandemic year’), and where to find turnover for 2019-20 or 2018-19 (the ‘reference period’), can be found here: Claim a grant through the Self-Employment Income Support Scheme – GOV.UK (www.gov.uk)

Upload a document to Companies House (CH)

This service was created to enable paperless filing in response to the coronavirus (COVID-19) outbreak. It is quicker to upload your documents than to send them by post.

You can use this service to file certain documents online that would usually be sent to CH in a paper format.

In this service, you can upload certain documents for:

- share capital

- registrar’s powers

- change of constitution

- insolvency (registered insolvency practitioners only)

Read the guidance to find out how to upload a document, including which documents you can file.

There is separate guidance for uploading insolvency documents.

A same day service is now available when sending form SH19 to CH via their ‘Upload a document to Companies House’ service.

See: Upload a document to Companies House (company-information.service.gov.uk)

Private providers of coronavirus (COVID-19) testing

The lists of and information about private providers who have self-declared that they meet the government’s minimum standards for the type of commercial COVID-19 testing service they offer has been updated.

See: Private providers of coronavirus (COVID-19) testing – GOV.UK (www.gov.uk)

Foreign travel insurance

If you are travelling abroad, it is advisable to take out appropriate travel insurance before you go.

To understand the risks in a country, including the latest COVID restrictions (including for entry), follow FCDO Travel Advice.

To prevent new COVID variants from entering the UK, you should not travel to red list countries.

Check what you need to do to travel abroad and return to England, or read travel guidance for Scotland, Wales or Northern Ireland.

The Foreign, Commonwealth & Development Office currently advises against all but essential travel to many countries and territories, due to coronavirus (COVID-19) risks. You should check the travel advice for your destination and read our COVID-19 travel advice. If you are legally permitted to travel internationally during the COVID-19 pandemic, and you decide to do so, you should have appropriate travel insurance.

If you already have a travel insurance policy, you should check what cover it provides for coronavirus-related events, including medical cover and travel disruption. If you are choosing a new policy, make sure you check how it covers these issues.

If you do not have appropriate insurance before you travel, you could be liable for emergency costs including medical treatment. It is recommended you buy your travel insurance as soon as possible after booking your trip.

See: Foreign travel insurance – GOV.UK (www.gov.uk)

Minimum standards for private-sector providers of COVID-19 testing for ‘Test to Release for international travel’

The government has published this guidance for private providers of ‘Test to Release for international travel’. By law, all tests used for the purpose of shortening the self-isolation period for international arrivals must meet certain minimum standards.

Providers must also complete a declaration that their tests meet these standards.

The minimum standards can be seen here: Minimum standards for private-sector providers of COVID-19 testing for ‘Test to Release for international travel’ – GOV.UK (www.gov.uk)

Guidance: pavement licences (outdoor seating)

A pavement licence is a licence granted by a local authority, or deemed to have been granted, which allows the licence-holder to place removable furniture over certain highways adjacent to the premises in relation to which the application was made, for certain purposes. This is a streamlined process to allow businesses to secure these licences quickly and, where they are deemed to have been granted, allow these licences to remain in place for a year but not beyond 30 September 2022. Where a pavement licence is granted, clear access routes on the highway will need to be maintained, taking into account the needs of all users, including disabled people.

The Business and Planning Act process for pavement licences provides a streamlined and cheaper route for businesses such as cafes, restaurants and bars to secure a licence to place furniture on the highway. This will provide much needed income for business and protect as many hospitality jobs as possible.

The fee for applying for a licence under the Business and Planning Act process is capped at £100 and the public consultation period is 5 working days (excluding public holidays), starting the day after the application is sent electronically to the authority.

See: Guidance: pavement licences (outdoor seating) – GOV.UK (www.gov.uk)

Advice for pregnant employees

This guidance contains advice for pregnant employees on risk assessments in the workplace and occupational health during the coronavirus (COVID-19) pandemic.

If you are pregnant and have let your employer know in writing of your pregnancy, your employer should carry out a risk assessment to follow the Management of Health and Safety at Work Regulations 1999 (MHSW) or the Management of Health and Safety at Work Regulations (Northern Ireland) 2000. This may involve obtaining advice from the occupational health department. See the workplace risk assessment guidance for healthcare workers and for vulnerable people working in other industries.

Information contained in the RCOG/RCM guidance on coronavirus (COVID-19) in pregnancy should be used as the basis for a risk assessment.

Pregnant women of any gestation should not be required to continue working if this is not supported by the risk assessment. Pregnant women require special consideration as contained in government guides for different industries.

See: Coronavirus (COVID-19): advice for pregnant employees – GOV.UK (www.gov.uk)

Keep Wales Safe: guidance for tourism and hospitality businesses

Guidance for tourism and hospitality businesses to keep employees and visitors safe during the coronavirus (COVID-19) pandemic.

Please see the updated UKHospitality Wales Guidance in addition to the Guidance for Tourism and Hospitality businesses. (Please watch this short film to help you find your way around the guidance).

Information is also available on recent and upcoming changes.

As each premises is different, businesses should read all guidance to understand the measures to be considered to operate the business safely.

For further information visit GOV.Wales.

International road haulage

This has been updated to state that insurance green cards are not needed from 2 August 2021 to drive in the EU (including Ireland), Andorra, Bosnia and Herzegovina, Liechtenstein, Norway, Serbia or Switzerland. Bus, coaches and HGV trailers will also be exempt.

See: Carry out international road haulage – GOV.UK (www.gov.uk)

International bus or coach services and tours: vehicle documents

See: International bus or coach services and tours: vehicle documents – GOV.UK (www.gov.uk)

International road haulage: HGV and trailer documents

See: International road haulage: HGV and trailer documents – GOV.UK (www.gov.uk)